va refinance rates made simple for new homeowners

What they are

VA loans are backed, not issued, by the Department of Veterans Affairs. va refinance rates matter when you replace an existing VA mortgage with an Interest Rate Reduction Refinance Loan (IRRRL) or a cash-out refinance. Lenders set pricing, and the VA guarantee helps keep costs competitive.

What affects your rate

Rates reflect your credit, debt-to-income, loan-to-value, property use, and term length. Paying discount points can buy down the rate; taking lender credits may raise it. The VA funding fee influences total cost more than the note rate. Ask about locks and any float-down option.

- IRRRL: streamline refi to lower payment or move to a fixed rate.

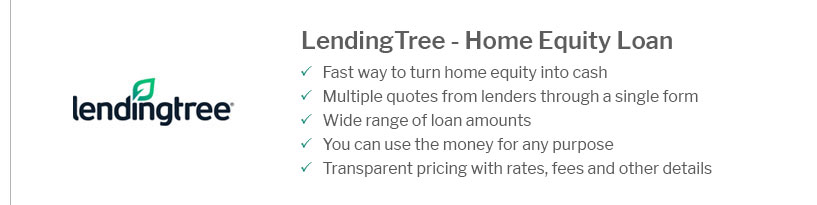

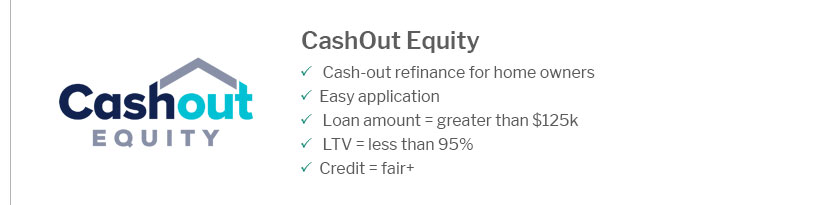

- Cash-out: taps equity; usually a higher rate.

- Discount points: pay upfront to reduce the rate.

- Credit strength: higher scores often earn better pricing.

- Term: shorter terms can price lower but raise payments.

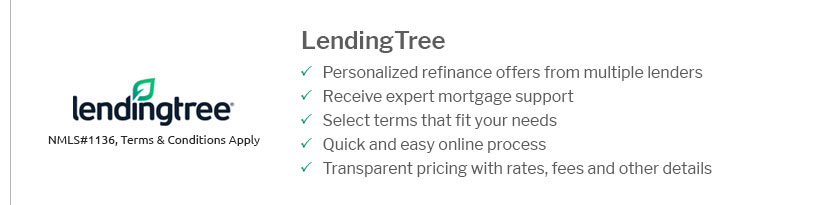

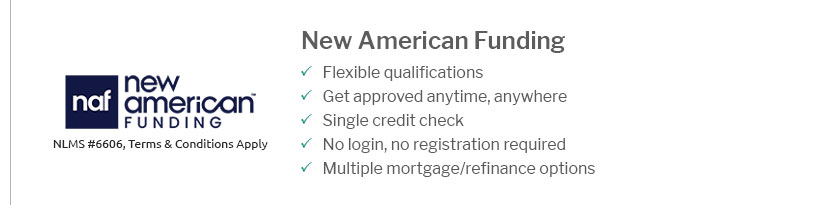

How to compare offers

Collect same-day quotes, review APR and cash to close, and estimate a break-even by dividing total costs by expected monthly savings. Check fees and confirm no prepayment penalty; many VA loans allow early payoff without extra charges.